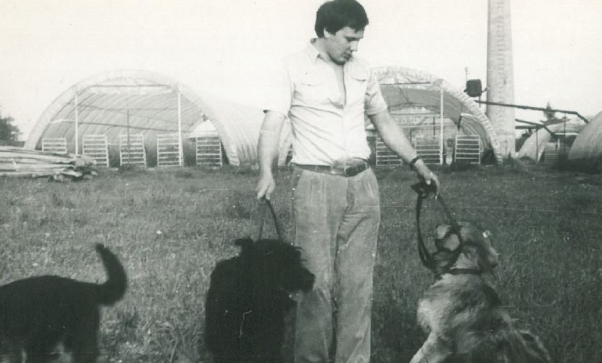

The history of TDJ goes back to the difficult for private enterprises times of the 1970s when in 1977 brothers Jacek and Michał Domogała set up their first business – the cultivation of asparagus and gillyflowers. In the following years, guided by their intuition, ingenuity and insights into the market, they changed their business profile by successively investing in an automotive sheet compressor, a shoe factory, and then in the production of ready meals.